colorado estate tax exemption

In 2006 voters amended Colorados Constitution to extend the senior exemption to disabled veterans. If an estate tax.

Veteran Tax Exemptions By State

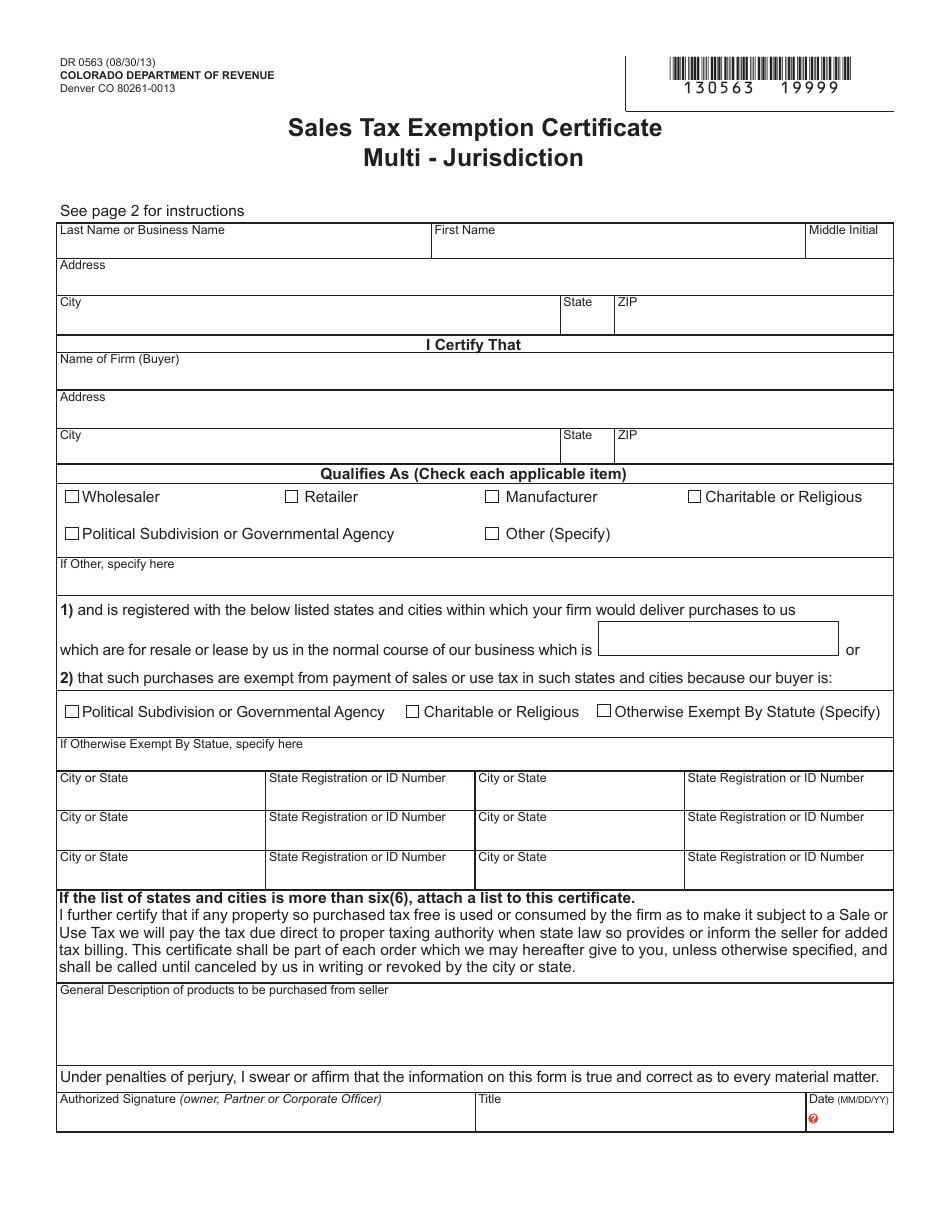

Certain products and services are exempt form Colorado state sales tax.

. Provides an exemption from property taxes. That means that if the right legal steps are taken a married couple can protect up to 2412 million when both spouses die. Disabled Veterans Exemption.

The amendment and subsequent legislation expanded the senior property tax exemption to include qualifying disabled veterans For disabled veterans who qualify 50 percent of the first 200000 of actual value of the veterans primary ce is residen. Age occupancy and. Even though there is no estate tax in Colorado you may still owe the federal estate tax.

39-3-124 for State Leased Space As of January 1 2009 the State will not be responsible for paying property taxes on state leased properties. The Colorado House of Representatives approved legislation Thursday to exempt period products and diapers from sales tax sending it to the state Senate for consideration. This tax is portable for married couples.

Provides a surviving spouse with shelter. The state constitution authorizes the general assembly to lower the maximum amount of the actual residential value of residential real property that is subject to the senior property tax exemption exemption. But even though Colorado does not have an exemption the federal government may assess tax against your estate.

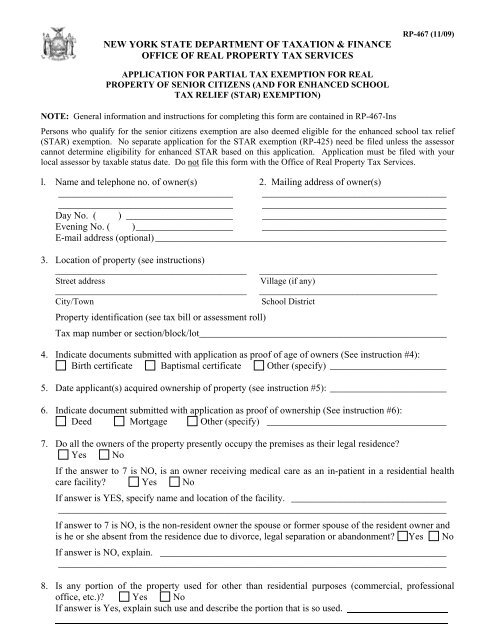

Colorado real estate transfer tax laws vary throughout the state so buyers should consult a local real estate professional for specific information. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. A property tax exemption is available to qualifying senior citizens.

Some states have decided to recently enact statutes to tax estates based on a certain exemption amount. Application for Property Tax Exemption. Applies to one primary residence.

The Colorado Homestead Exemption Amount. The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in 2022. Qualifying veterans are.

The Colorado estate tax is based on the state death tax credit which until 2005 was allowable on federal. If enacted House Bill. The State Treasurers office distributes state funds to the county where the exempted property is located.

Colorado estate tax planning. Seniors andor surviving spouses who qualify for the property tax exemption must submit an application to their county. 1 inheritance taxes which are.

In 200 Colorado voters amend6 section 35ed of article X of the Colorado Constitution. Homestead exemption amounts. If the Colorado Department of Revenue determines that an organization qualifies the organization will receive a Certificate of Exemption that authorizes it to purchase items and services without paying state sales tax and state-administered local sales taxes when these items and services are used to conduct the organizations regular charitable function.

However estate income tax returns can be fairly complex even if there is very little income. While federal law still imposes estate taxes on certain estates only about two of every 1000 people who pass away or 02 percent have to pay any taxes at all. Tax Exempt Status CRS.

The Colorado Homestead Law. Select Popular Legal Forms Packages of Any Category. Section 3 of the bill lowers the maximum amount to 0 for all property tax years beginning on and after January 1 2020 which has the effect of.

Currently exempt property owners are required to file annual reports with the DPT in order to continue exemption. Included within the bill is the requirement of. Currently the estate tax has an exemption amount of over 5 million and a tax rate of 35.

So you are aware that there is no estate tax in Colorado. Colorados statutory homestead exemption exempts a portion of a homestead from seizure to satisfy a debt contract or civil obligation. The homestead exemption is 105000 if the homeowner his or her spouse or dependent is disabled or 60 years of age or older.

Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein. From 75000 to 250000 if the homestead is occupied as a home by an owner of the home or an owners family. Also exemptions may be specific to a state county city or special district.

Residential Properties Specific Forms For Charitable-Residential Properties Additional Forms Late Filing Fee Waiver Request Remedies for Recipients of Notice of Forfeiture of Right to Claim Exemption Instructions and FAQs Annual Reports for Exempt Property Schools Charitable 2022. Life estate box will assist the assessors office in processing your application. Colorado seniors are eligible for a property tax exemption if they are.

Section 2 increases the amount of the homestead exemption. Colorado estate tax applies whether the property is transferred through a will or according to Colorado intestacy laws. You can own it with your spouse or with someone else.

All Major Categories Covered. Under the Colorado exemption system homeowners can exempt up to 75000 of their home or other property covered by the homestead exemption. You do not have to be the sole owner of the property.

Have been the primary occupant for at least ten consecutive years prior to January 1. Real estate transfer taxes are an especially tricky issue in Colorado as the state passed a constitutional amendment in 1992 freezing all real estate transfer taxes and prohibiting any new. The Exemptions Section is responsible for determining qualification for exemption from property taxation for properties that are owned and used for religious charitable and private school purposes.

Property taxes are collected by the county therefore each department will be responsible for informing the local county assessor of buildings leased by the state. Currently the estate tax has an exemption amount of over 5 million and a tax rate of 35. Carefully review the guidance publication linked to the exemption listed below to ensure that the exemption applies to your specific tax situation.

The section provides assistance to counties and taxpayers with. Prevents a forced sale of a home to meet demands of creditors. You are the current owner of record and you have owned the property for at least 10 consecutive years prior to January 1 of the tax year for which you are seeking the exemption.

The property need only be declared exempt once and that declaration will carry forward every year. There are three types of taxes imposed on the transfer of assets at death. If you are a personal representative or executor you should make sure your accountant knows how to prepare an.

Estate income tax is a tax on income like interest and dividends. Colorado estate tax limit. The Colorado Homestead Exemption allows one to exempt up to 75000 of their real property value when filing.

If you meet the criteria above you may apply using a Short Form Application.

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Form Dr0563 Download Fillable Pdf Or Fill Online Sales Tax Exemption Certificate Multi Jurisdiction Colorado Templateroller

What Is A Homestead Exemption And How Does It Work Lendingtree

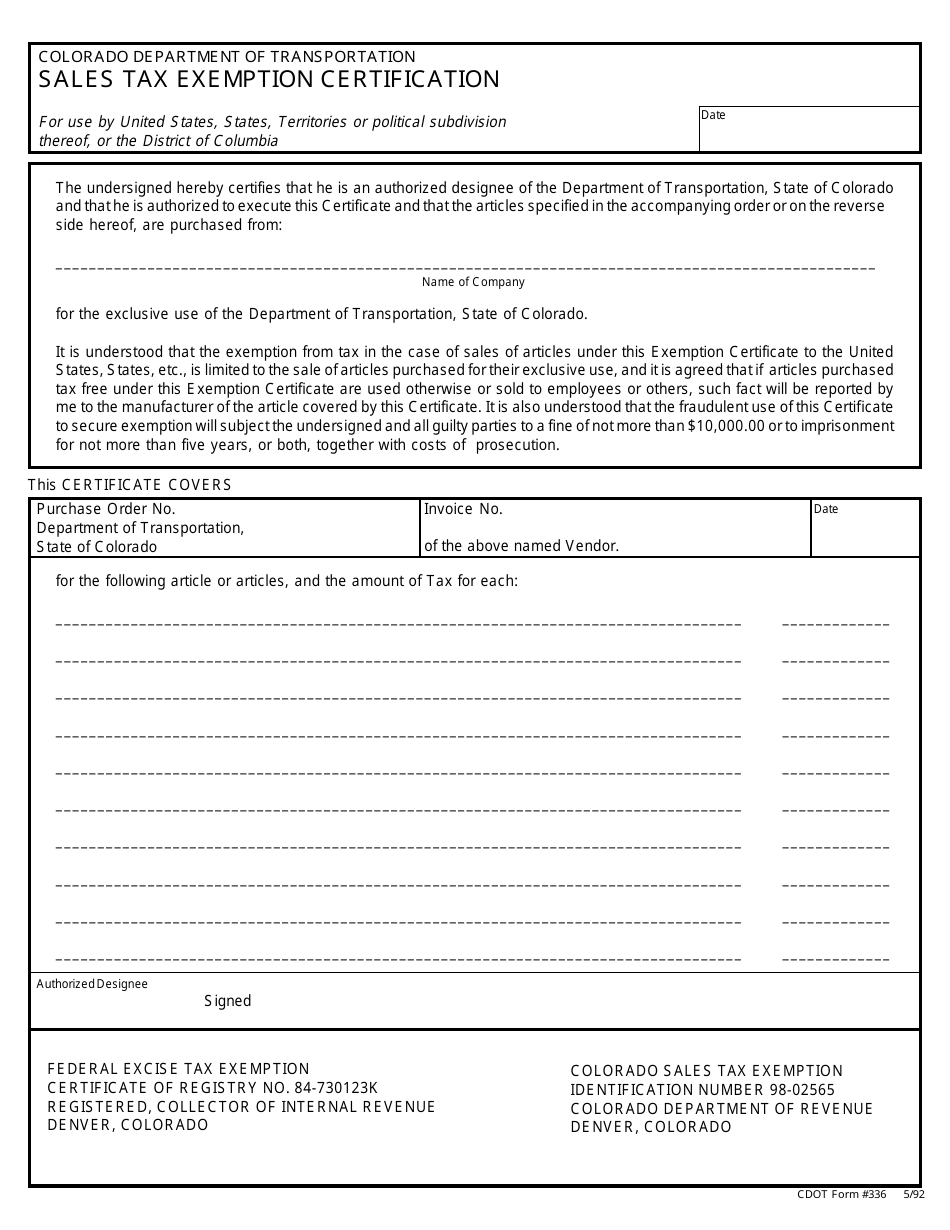

Cdot Form 336 Download Printable Pdf Or Fill Online Sales Tax Exemption Certification Colorado Templateroller

Colorado Estate Tax Everything You Need To Know Smartasset

This Is The Final Piece Of Stage 1 High School Organization School Organization High School

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Don T Let Higher Estate Tax Exemptions Make You Complacent About Transition Planning Valuation Buysellagreements Bus Estate Tax Tax Exemption How To Plan

How To Avoid Estate Taxes With A Trust

A New Era In Death And Estate Taxes

Application For Partial Tax Exemption For Real Property Of Senior

County Commissioners Approve Resolution Supporting The Homestead Tax Exemption El Paso County Assessor

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Property Tax Exemptions For Nonprofits Blue Co Llc

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute