south dakota sales tax rates by county

Tax rates provided by Avalara are updated monthly. This rate includes any state county city and local sales taxes.

Sales Use Tax South Dakota Department Of Revenue

The 2018 United States Supreme Court decision in South Dakota v.

. Brookings County SD Sales Tax Rate Brookings County SD Sales Tax Rate The current total local sales tax rate in Brookings County SD is 4500. Your businesss gross revenue from sales into South Dakota exceeded 100000. For cities that have multiple zip codes you must enter or select the correct zip code for the address you are supplying.

Enter a street address and zip code or street address and city name into the provided spaces. Redfield SD Sales Tax Rate. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

Lowest sales tax 45 Highest. The 2018 United States Supreme Court decision in South Dakota v. Ad Lookup Sales Tax Rates For Free.

The South Dakota Department of Revenue administers these taxes. South Dakota has a higher state sales tax. Has impacted many state nexus laws and sales tax collection requirements.

The Moody County sales tax rate is. 365 rows 2022 List of South Dakota Local Sales Tax Rates. The latest sales tax rate for Rapid City SD.

31 rows Rapid Valley SD Sales Tax Rate. The average salary for a Retail Sales in South Dakota is 35000 per year. While many counties do levy a countywide sales tax Lake County does not.

The total sales tax rate in any given location can be broken down into state county city. What is South Dakotas Sales Tax Rate. The South Dakota state sales tax rate is currently.

The sales tax rates database is available for either a one-time fee or a discounted subscription that will provide you with monthly updates for all local tax jurisdictions in South Dakota. Retail Sales salaries in South Dakota can vary between 19000 to 62500 and depend on various factors including skills experience. The total sales tax rate in any given location can be broken down into state county city.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. To review the rules in South Dakota visit our state-by-state guide. South Dakota law also requires any business without a physical presence in South Dakota to obtain a South Dakota sales tax license and pay applicable sales tax if the business meets one or both of the following criteria in the previous or current calendar year.

Interactive Tax Map Unlimited Use. Average Local State Sales Tax. The Clay County sales tax rate is.

Our dataset includes all local sales tax jurisdictions in South. The South Dakota sales tax of 45 applies countywide. Tax rates provided by Avalara are updated monthly.

To review the rules in South Dakota visit our state-by-state guide. Look up 2021 sales tax rates for Day County South Dakota. Free sales tax calculator tool to estimate total amounts.

Has impacted many state nexus laws and sales tax collection requirements. The South Dakota sales tax and use tax rates are 45. Look up 2021 sales tax rates for Buffalo County South Dakota.

2020 rates included for use while preparing your income tax deduction. Click Search for Tax Rate. Look up 2021 South Dakota sales tax rates in an easy to navigate table listed by county and city.

Click any locality for a full breakdown of local property taxes or visit our South Dakota sales tax calculatorto lookup local rates by zip code. South Dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Heres how Lake Countys maximum sales tax rate of 65 compares to other counties around the United States.

Municipalities may impose a general municipal sales tax rate of up to 2. The December 2020 total local sales tax rate was also 4500. If you need access to a database of all South Dakota local sales tax rates visit the sales tax data page.

Some cities and local governments in Lake County collect additional local sales taxes which can be as high as 2. The South Dakota state sales tax rate is currently. These insights are exclusive to Mint Salary and are based on 37 tax returns from TurboTax customers who reported this type of occupation.

What Rates may Municipalities Impose. 11 rows The total sales tax rate in any given location can be broken down into state county city. Searching for a sales tax rates based on zip codes alone will not work.

South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax.

Sales Use Tax South Dakota Department Of Revenue

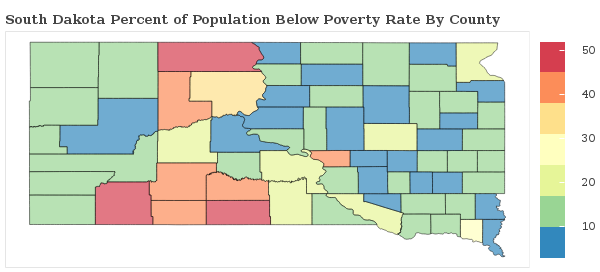

South Dakota Welfare Learn And Find Benefits

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

South Dakota Sales Tax Small Business Guide Truic

Tax Information In Tea South Dakota City Of Tea

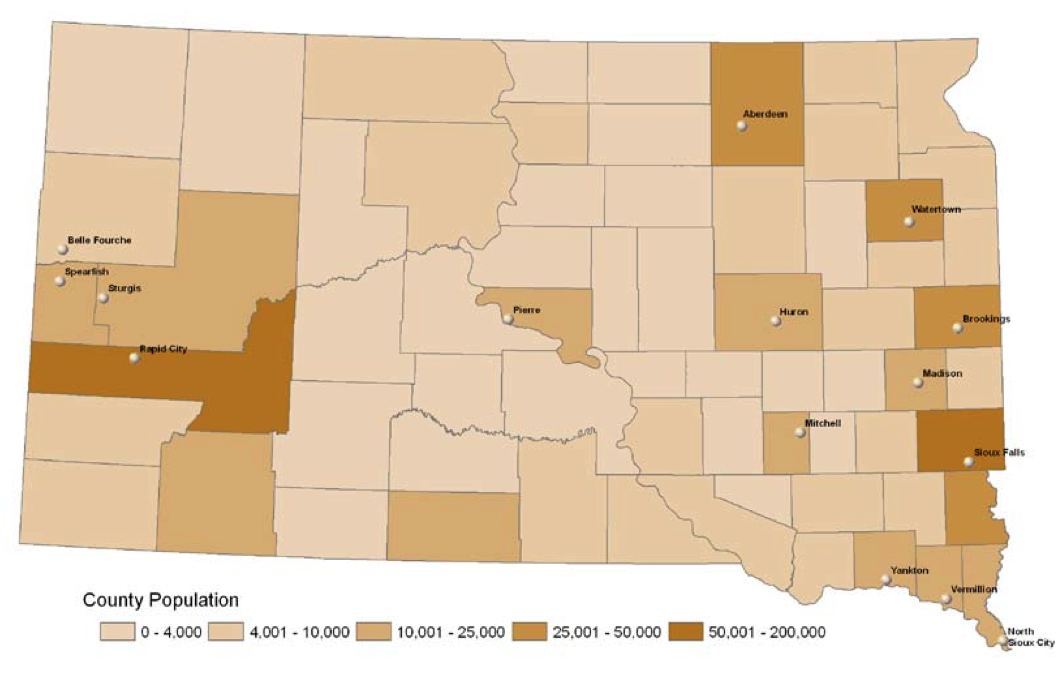

Demographics Of South Dakota Wikipedia

Vs Outbreak Surveillance Toolbox

The Best And Worst States For Retirement 2021 All 50 States Ranked Bankrate Clark Howard Retirement Life Map

Sales Use Tax South Dakota Department Of Revenue

2021 Best Places To Raise A Family In South Dakota Niche

Demographics Of South Dakota Wikipedia

Income Tax Filings In These Counties Were Audited At A Lower Rate Than The Nation As A Whole Infographic Map Native American Reservation Months In A Year

Sales Use Tax South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

Map How Much 100 Is Really Worth In Every State Map States Cost Of Living

South Dakota Sales Tax Rates By City County 2022

No Covid 19 Case Count Update For South Dakota On Monday Keloland Com